Debt is a part of life, whether you like it or not. It comes in many forms; mortgages, car loans, personal loans, credit cards, student loans, lines of credit and margin loans.

Debt is able to be used in many ways, as a funding option to achieve a goal in the shorter term; to purchase or upgrade your home in the medium term, and to accelerate the process of wealth creation over the long term.

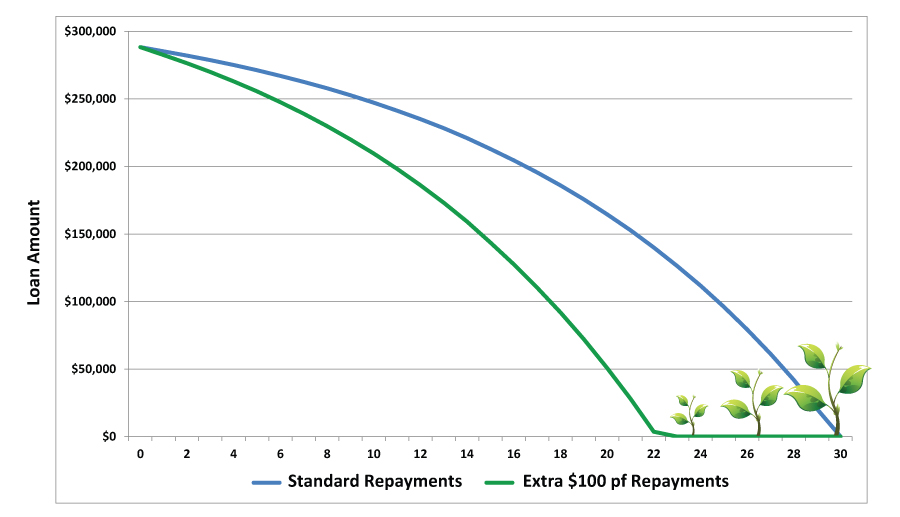

Debt reduction strategies vary – they can be as easy as paying an additional $100 per fortnight off your mortgage. This is outlined in the above graph. Using the average Australian mortgage of $288,300 at a rate of 7.00%, the interest saved amounts to over $122,000 and a loan term reduction of 7.8 years.

Overlaying additional debt strategies can further reduce the interest paid and have your mortgage paid off sooner.

Combined with an investment strategy, your financial freedom will become a reality sooner.

Speaking to an advisor at FFBD will help ensure you are on the path to reducing non-deductible debt as quickly as possible, and also have someone to be accountable to and assist you.

Please find below a link to an interactive loan repayment calculator to see how you are currently tracking to repay your mortgage.

http://www.nab.com.au/wps/wcm/connect/nab/nab/home/Personal_Finance/22/2/8/1/