What is your most important asset?

Your house? Your car?

It is you! Your life and your ability to earn an income over the long term is your greatest asset. Is it protected? Could you still afford your lifestyle and debts if something happened to you or your family?

Consider this, 60% of Australian families will run out of money within 12 months if the main income earner dies. Of the working population in Australia, one in six men and one in four women are expected to suffer a disability from the age of 35 to 65 that causes a loss of six months or more from work1.

If you are protected, you and your family will have peace of mind knowing that in the event of death, illness or injury, you can continue to afford your current lifestyle. Think of insurance as a way of funding a savings account from which your family can draw in the event of misfortune.

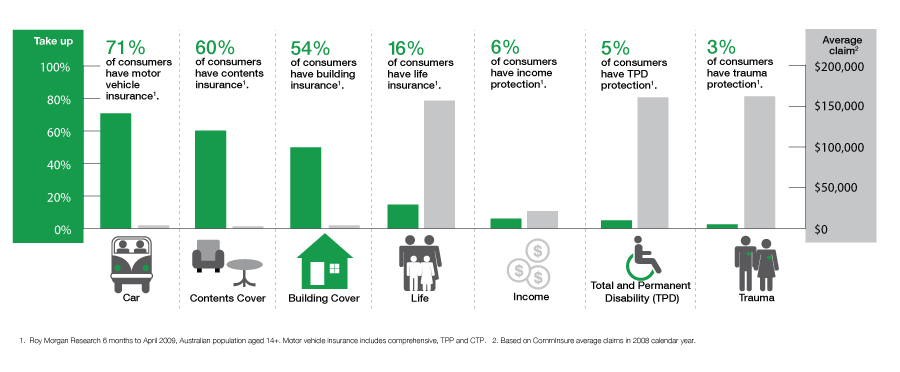

There are 5 different types of personal insurance you can put in place. These are:

– Life cover – this pays you a lump sum in the event of death. Most people want to have enough to ensure they can repay their debts and an amount to cover the lost income of the deceased

– Total and Permanent Disablement cover – this cover pays a lump sum in the event you suffer a TPD and will never work again. This can help to cover the repayment of debt, medical/recovery costs and the cost of care.

– Income Protection cover – this cover will pay a monthly benefit if you cannot work for a specific period of time due to sickness or injury. The waiting period can start from 14 days, and based on severity, can continue until age 70.

– Trauma (or Critical Illness cover) – this cover will pay a lump sum upon diagnosis of a Critical Illness. The most common Critical Illnesses are Cancer, Heart Attack, Heart Disease and Stroke, but dozens of other conditions are included. This payment can help with medical costs and recovery.

– Business expenses cover – this provides for reimbursement of business expenses should you be unable to work for a period of 12 months.

The benefits of seeing a financial advisor to assist with your personal insurance include:

– A structured approach to identify the amount of personal insurance required

– Cost to be arranged in a way to ensure your personal insurance will be in place for the long term, and premiums will not continually increase

– Determine the best possible way to fund the premiums

1. Institute of Actuaries. Table IAD 89-93 – white collar males and females.